Australian Housing Downturn

CoreLogic’s July Home Value Index results, released today, reveals national dwelling values are falling at their fastest annual rate since 2012.

Australian Housing Downturn

Australia’s housing downturn is gathering in momentum, according to CoreLogic’s July Home Value Index results.

The data confirms national dwelling values are continuing their weak run, as both capital city and regional dwelling values trend lower over the past three months.

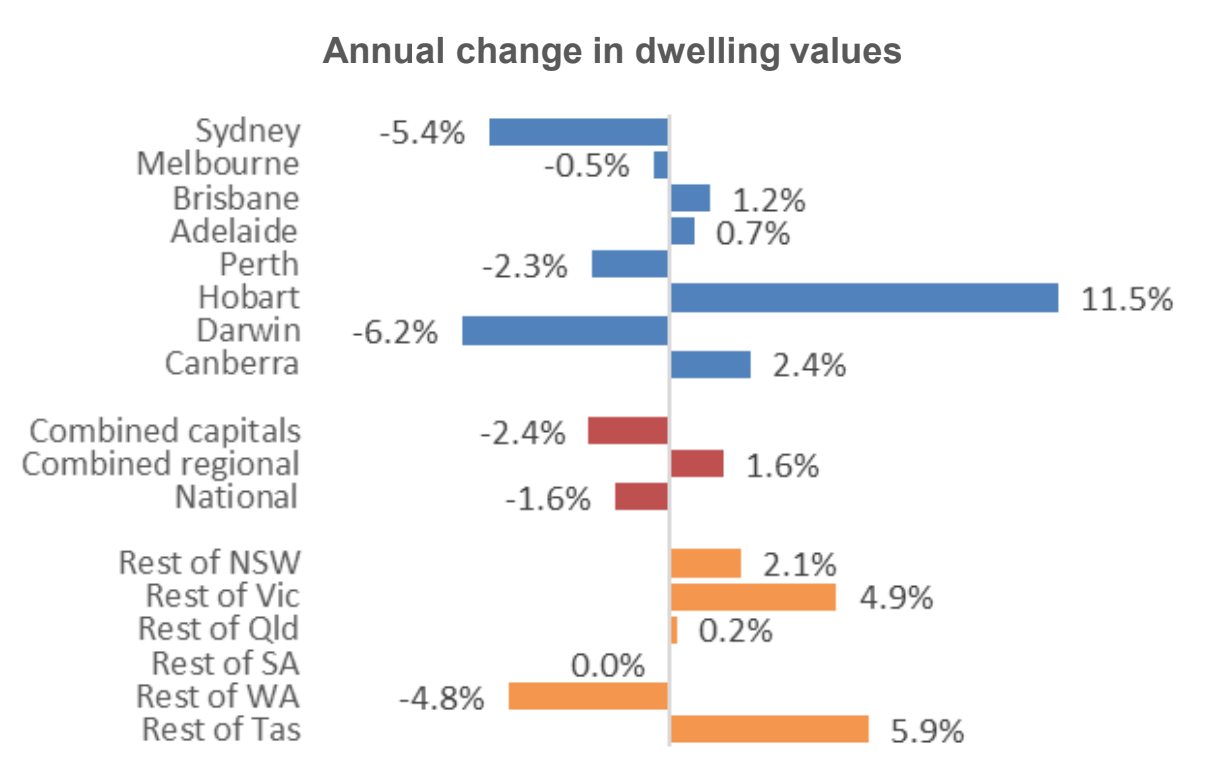

National house prices fell for the 10th consecutive month in July, with the 0.6 per cent month-on-month fall bringing the annual decline to 1.6 per cent — the fastest rate since August 2012.

House prices are now 1.9 per cent below their September 2017 peak, but are still 31 per cent higher than five years ago.

Australian home prices fell sharply in July, recording the largest monthly fall in nearly seven years

Prices fell in a majority of capitals, and in regional centres.

The declines were once again led by falls in Melbourne and Sydney

The best performing capital city was Hobart, with dwelling values increasing by 1.1 per cent

CoreLogic expects prices will continue to fall in the second half of the year

CoreLogic says the weakness is being driven by long-running declines in Perth and Darwin, and an acceleration of the rate of decline in Sydney and Melbourne.

“We can’t see any factors that may halt or reverse the housing market’s trajectory of subtle declines over the second half of 2018,” CoreLogic head of research Tim Lawless said.

“The availability of housing credit has been a significant factor contributing to this slowdown, however there are a variety of hurdles contributing to slower conditions.”

Prices fell in five of Australia’s eight capital cities in July, as well as regional areas, as seen in the right side.

Melbourne overtakes Sydney as weakest performing housing market

Australia’s housing downturn is gathering in momentum, according to CoreLogic’s July Home Value Index results.

The data confirms national dwelling values are continuing their weak run, as both capital city and regional dwelling values trend lower over the past three months.

National house prices fell for the 10th consecutive month in July, with the 0.6 per cent month-on-month fall bringing the annual decline to 1.6 per cent — the fastest rate since August 2012.

House prices are now 1.9 per cent below their September 2017 peak, but are still 31 per cent higher than five years ago.

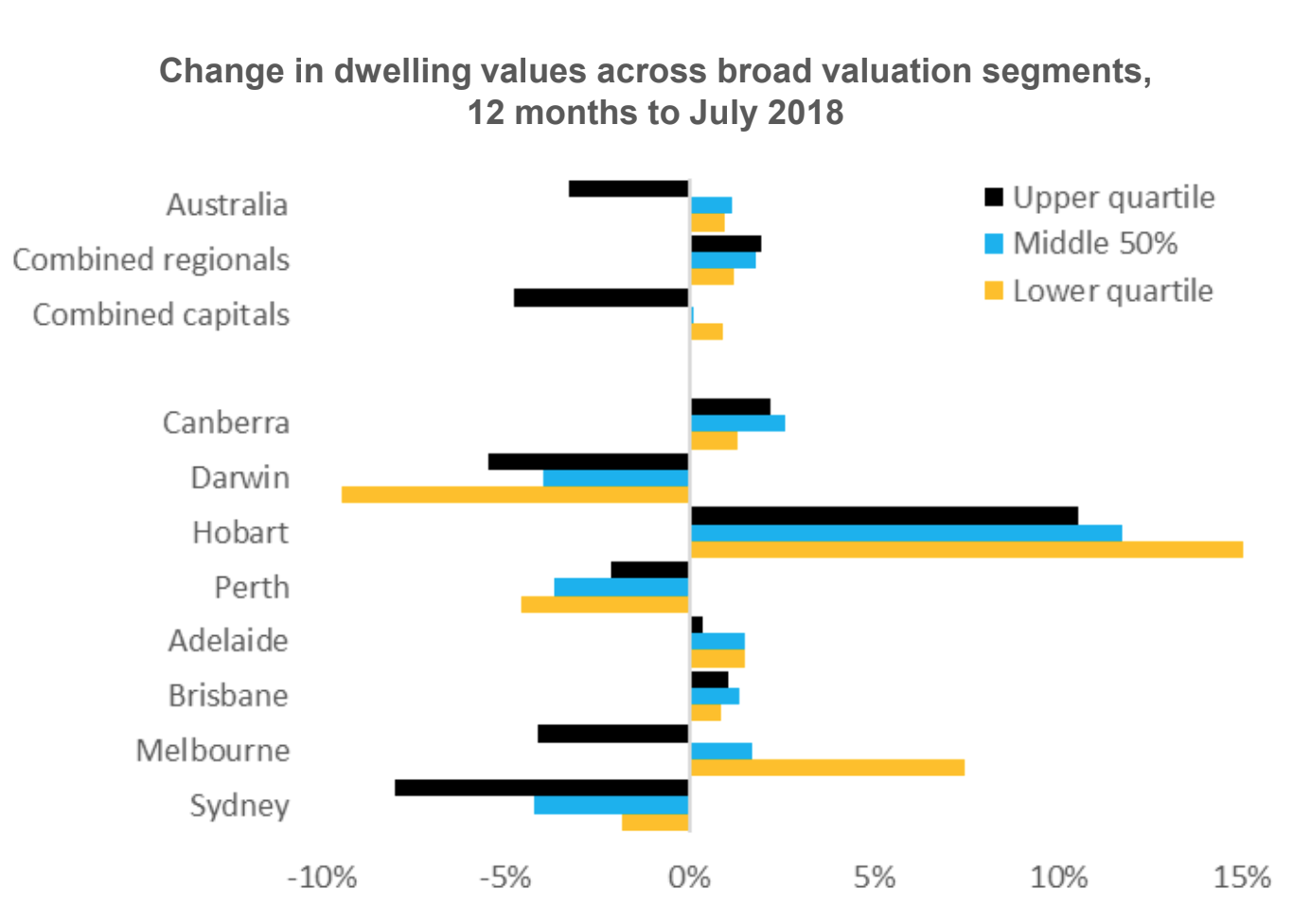

CoreLogic says the most acute declines in Melbourne and Sydney over the past year have occurred at the top end of the market, which has been the case for several months. However, some Melbourne agents say it’s ‘illogical’ to judge the entire state of the market based off a few percentage points.

“The market is so unpredictable – the market is levelling out at the moment, and it will play catchup and rise again. We are still selling heaps of property and there are still plenty of buyers for all these houses, so it is still your best investment,” Jeremy Fox, Director of RT Edgar Toorak told WILLIAMS MEDIA.

“At the moment, there is a shortage of stock. Unless they really need to sell, vendors will pull back and take their houses off the market and wait, so I believe it is the beginnings of all that. People who don’t need to sell will just wait. If there is any uncertainty, they will just wait it out,” Fox said.

Strong growth cities also affected

Those cities where values continue to trend higher have also seen a sharp reduction in their rate of capital gain.

In Brisbane and Adelaide, where housing values were rising at a more sustainable pace over the past five years, the annual rate of capital gains has weakened.

In Brisbane, the annual rate of growth has eased from 2.9 per cent a year ago to 1.2 per cent over the past twelve months and in Adelaide the annual growth rate has dropped from 5.4 per cent a year ago to just 0.7 per cent over the most recent twelve month period.

Even the Hobart market, where the annual pace of capital gains has held in double digit growth territory since January 2017, is starting to slow down.

Related reading: Is it really a case of “buyer beware” in Tasmania?

Dwelling values were steady over the month and the annual rate of growth slowed to 11.5 per cent; still strong but the slowest annual growth rate since February 2017.

Pam Corkhill, agent with Knight Frank Hobart told WILLIAMS MEDIA she doesn’t think the drop predicted for the Tasmanian housing market will be as “tremendous” as people are saying.

“The market will slow down, but at the moment it is still very strong. If it does drop, it won’t drop tremendously,” Corkhill said.

“For generations, the property market has gone in peaks and troughs and it always will. We have never, ever experienced the peaks and troughs the mainland capital cities have. It has always been gentle.

Premium end of market hit hard

“The starkest annual performance differential is in Melbourne, where the top quartile has seen values fall 4.1 per cent over the past twelve months while property values across the lower quartile are 7.5 per cent higher,” Lawless said.

Similarly, in Sydney, dwelling values are down 8.0 per cent across the most expensive quarter of the market, while the most affordable quarter of the market has seen values fall by a much lower 1.8 per centover the past twelve months.

According to Lawless, “This dramatic performance differential in Sydney and Melbourne is attributable to a range of factors, however most importantly, the surge in first home buyers has supported demand and the lower end of the market and the tightening of credit has led to reduced borrowing capacity for many borrowers.”

“The surge in first home buyer activity evident since stamp duty concessions were introduced across New South Wales and Victoria in July last year has propped up demand across the more affordable end of the housing market, while a new focus on borrowers with a high debt to income ratio is likely to be dampening the amount of funds available for purchasing expensive dwellings,” Lawless continued.

Ken Jacobs, an agent with Christie’s International Real Estate agrees that while the banks are having an impact on lending, the softening prices “aren’t that dramatic”.

“I do agree that prices are softening in the market, but this isn’t across the board. The banks are certainly an issue with the Royal Commission, which is making them tighten up their lending standards and become more compliant which is clogging up the system. The banks have been very slow to make decisions, so that is having an impact,” Jacobs told WILLIAMS MEDIA.

“There is a lot of uncertainty around. There are still transactions happening in our luxury end of the market, and prices that we would have expected and achieved last year.

“There is also a lack of stock, because vendors are reading about prices dropping and they are thinking “well, why would I go into the market now?” so that is having an impact too,” Jacobs concluded.

We're Here To Help!

Office

Mitchell Residential

PO Box 369 Scarborough

Sunset Coast 6019 West Australia Lic. RA 76396 ABN 72526925107

Call Us

[08] 9245 5553

mres@iinet.net.au